Is active assailant insurance the next cyber?

Active assailant coverage may move from a luxury to standard protection

Just as cyber insurance became indispensable in the digital age, active assailant coverage may soon be standard practice in a world where physical and reputational risks are increasingly intertwined

Active assailant insurance is not just a product, it is a signal – a signal organisations are rethinking risk in a more holistic way and insurers are stepping up with solutions that reflect the complexity of modern threats.

As the market grows, expect to see more tailored policies, sector-specific endorsements and integration with broader crisis management frameworks. Just as cyber insurance became indispensable in the digital age, active assailant coverage may soon be standard practice in a world where physical and reputational risks are increasingly intertwined.

The first active assailant insurance policies began to appear in the insurance market around 2011/12, filling a gap traditional property and liability policies could not reach.

These policies were developed in response to the increasing frequency of mass shootings and violent attacks, particularly in the US and Europe. Designed to respond to violent incidents involving weapons – not just firearms, but anything from corrosive substances to drones – these policies offered something new: protection that extended beyond physical damage to include crisis management, victim support and business interruption.

Active assailant policies can differ from active shooter, as active assailant policy forms can give a wider scope of coverage for a trigger: active assailant coverage can be for any weapon, even a baseball bat.

Growing demand

Over the years, there has been a slow increase in both supply and demand for active assailant insurance. However, much like cyber insurance in the early days, many insureds still see active assailant policies as a luxury.

The industries most exposed to these risks, such as education and public institutions, often lacked the budget flexibility to accommodate what insurers considered reasonable premiums.

It is a sobering reality that this type of coverage is gaining traction. From an insurance perspective, the trend is clear: active assailant insurance is no longer a fringe product, it is a strategic tool for organisations that want to be prepared, protected and proactive

With mandatory lines like property, casualty and professional indemnity already locked in, active assailant cover was frequently pushed to the bottom of the list. Policyholders were pushed to prioritise other lines of coverage that are also likely to be enforced via government or contractual requirements.

This view, however, is changing. The global active assailant insurance market reached $1.35bn in premium in 2024 and is projected to rise at a 17.6% compound annual growth rate, hitting $5.25bn by 2033. Additionally, new workplace violence mandates in California and New York are pushing employers to formalise prevention plans and insurers are watching closely.

Into the mainstream

Much like GDPR and data breach laws accelerated cyber adoption, these regulations are nudging active assailant coverage into the mainstream – especially for organisations with large public footprints or complex liability exposures.

Policyholders are now able to allocate the necessary budgets to afford the necessary premiums. While insurers focused on active assailant lines may not be able to gain as broad a portfolio in terms of industries served, their penetration into certain industry verticals is likely to increase exponentially in the coming years, perhaps growing to become a standard coverage for these client bases, much like has been seen with cyber over the past decade.

It is a sobering reality that this type of coverage is gaining traction. From an insurance perspective, the trend is clear: active assailant insurance is no longer a fringe product, it is a strategic tool for organisations that want to be prepared, protected and proactive.

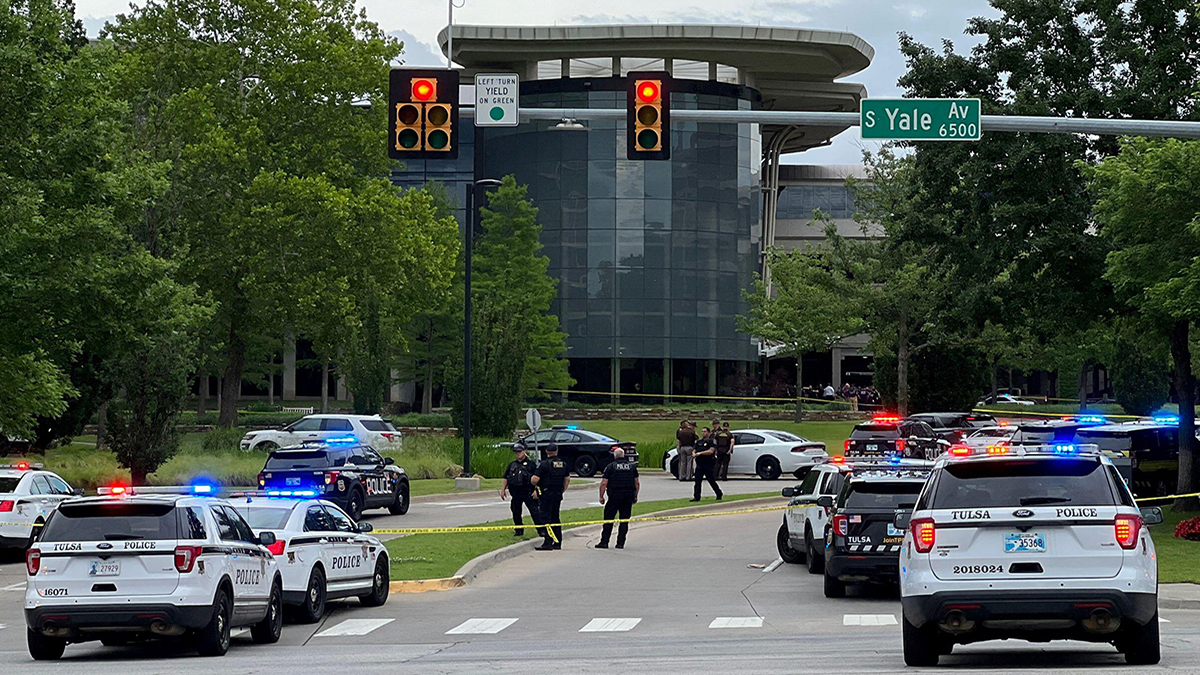

Recent events in the news are just the latest in a long and growing list of high-profile cases that could see many prospective insureds reconsider their stance on purchasing coverage if they are not doing so already.

The active assailant market is only moving in one direction and is perhaps the next coverage type in line to accelerate as the frequency and severity of these events increase under what seems to be an ever-polarising political landscape.

Archie Whitehead is senior technology, media and cyber broker at New Dawn Risk